The Solar Boom

Solar energy has been the most rapidly increasing source of power since 2000. In just 20 years, the energy generated by solar panels has increased by 30 000%!

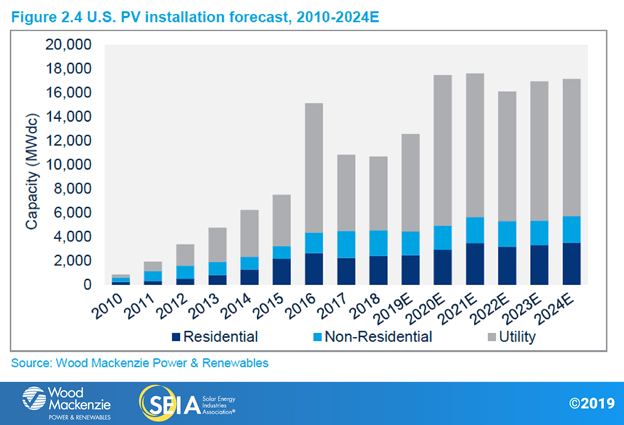

The largest forecasted growth is in utility scale solar as shown below.

Many articles and papers have been written on the future of Solar Power1,2,3,4. In general, they point to a boom and continuing growth as the result of many factors. Shifting public opinion, increased government subsidies and incentives have resulted in increasing investment in R&D. This has led to a snowballing effect: higher quality and less expensive solar panels increase consumer interest which increases investment in R&D. Additionally, as solar becomes a cheaper source of electricity, many other non-renewable energy sources are becoming more expensive.

Instead of covering more fully or beautifully that same topic, this article addresses the massively overlooked impact that battery innovation will have on the solar market.

Battery Innovation

Compared to just ten years ago, there have been an incredible number of breakthroughs in the battery industry. Some examples include: a battery the size of an AA that can start a car, batteries that use sand, and new ceramic electrodes that might triple the existing capacity. Experts predict that the number of power cycles a lithium-ion (Li-ion) battery can have over its lifetime will increase. This will be especially important in the development of electric vehicles and bidirectional charging. The most optimistic predict as many as a 30,000 power cycles. Cycle-life depends on how much you discharge the battery, but in good conditions current lithium ion batteries can deliver up to 4000 cycles.

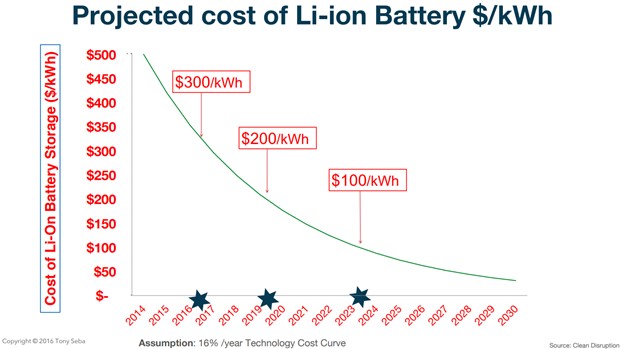

A good discussion of many of the battery advancements of the last year can be found on Chris Hall’s Blog. Likely the most important breakthroughs that will enable solar power are those driving the huge reductions in cost. One breakthrough has discovered new electrodes that might reduce the manufacturing costs of the battery by 90%! Tony Seba, a well renowned angel investor, suggested in 2016, the following exponential decrease in Li-ion battery costs.

These projections have been backed by trends that we can see retrospectively. In Germany, the cost of small-scale batteries have fallen by more than 60% since 2014! In fact, Tony Seba’s projection seems to be even a little pessimistic as battery packs in 2019 were on average at $156/kWh compared to the $200/kWh shown.

These innovations will have far reaching impacts on both the commercial and residential solar markets.

Commercial Market:

On an industrial scale, solar energy is generated through solar farms which are large scale installations of solar panels. Some solar farms are required to have batteries to store the energy that they produce in order to meet grid output requirements. Many farms that are not required to have energy storage are already moving to do so5,6. When solar farms have no storage, they must immediately sell all energy produced. By contrast, solar farms that have batteries can store some or all the energy they produce and can therefore, choose when to sell their energy. This results in much higher return on the electricity produced as it can be sold at peak times when it is worth substantially more.

The impact of these batteries on the commercial market is simple. Startup costs will be reduced as batteries become cheaper. Longer battery lives mean that these farms will need to replace old batteries less often. Longer replacement times and lower cost batteries reduce the operational costs. What does this mean in terms of some numbers? Below, is an exploration of the numbers based on this breakdown of the costs associated with solar farms.

Today, batteries are the most expensive component of solar farms at 140% the cost of the solar modules. The startup costs of a solar farm are made up of many different components including labor, interconnection fees, and land costs. Amongst all of these costs, a decrease in the price of batteries by 70% would in a significant decrease at 19% of the total startup cost. Operational costs would be decreased even more. Given that batteries in solar farms have about half the life span of solar panels, and assuming the same 70% decrease in battery prices, the equipment costs would be reduced to 30% of their current value.

Residential Market

The current model

Most residential solar systems currently operate on a system of net metering, whereby any excess power is “sold” back to the grid. Utility companies use one of three pricing models for solar producers: tiered, time of use, or flat rates. Time of use rates are those which change depending on when the electricity is purchased (or sold). Tiered rates are kind of like taxes. The first x kWh are sold at a low rate. If you exceed x kWh the next y kWh will be charged at a higher rate and so on. Finally, flat rates are just a predetermined price per kWh that applies regardless of when or how many kWh are used.

This model is the reason that having a solar system can be financially viable and is the main reason for the adoption of solar panels by many residential consumers. However, it still leaves certain problems. This “sale” will almost never manifest in the form of actual money but instead in the form of energy credits that you can use to offset your bill. Additionally, these credits will usually only be able to be used to offset your usage costs. Therefore, regardless of how much energy your system creates, you would still need to pay the fixed costs.

Finally, if you are connected to the grid, the energy produced by the solar panel is directly sent onto the grid and all of the electricity you use is pulled from the grid. This means that in the event of a brownout or blackout, people with solar panels are in the same situation as those without. In other words, having a solar panel does not on its own protect the owner from power outages.

The impact that these battery breakthroughs will have on the residential market is more complex than on the commercial market but can be summarized with four use cases.

1. Reduce on-peak electricity usage

Many utility providers use Time of Use (TOU) pricing models. These models result in large discrepancies in the cost of purchasing electricity even on a given day. For example, Ontario Hydro has on-peak pricing of more than twice the off-peak price.

Therefore, if you had a high-capacity, long lived, inexpensive battery, you could choose to store the electricity you made with your solar panels and then make sure to use as much of the stored as possible during peak usage times. This could mean that you could substantially reduce your electricity costs when producing less than you use. Essentially, you could make it so that you would only ever pay off-peak prices for your electricity.

2. Backup Power Storage

Due to factors such as increased dependence on uninterrupted power and higher numbers of power interruptions and outages, the demand for backup power is also increasing. Today, using a battery instead of a gas-powered generator costs more up front. However, as battery prices diminish the upfront cost will come closer to parity, and may even undercut the prices of gas powered generation.

Additionally, using a battery as a backup power source has advantages in terms of ease of use. Gas powered generators make a lot of noise, emit fumes, require regular maintenance, and need fuel storage if not connected to a natural gas line. By contrast, batteries are noiseless, do not emit any exhaust, and are virtually maintenance free once installed.

While using a battery for storage does not need to be associated with a solar panel, it makes a lot of sense to do so as it enables our first use case and also allows you to have a certain storable power source that is not dependent on the grid at all.

3. Living off grid

The existence of these batteries can allow for energy independence and being “off-grid”. It has been estimated that 12% of Americans will be living off grid by 2035. The energy needs of these ~40 million people could be completely met with solar power connected to high-performing and low cost batteries. It will become more and more viable to disconnect from the electricity provided by the grid and to self-sustain using solar panels and batteries.

4. Joining a Virtual Power Plant (VPP) to sell your solar power

This is one of the most exciting up-and-coming topics in both the solar and the battery industries which will be covered more in depth in an upcoming post. For most utilities, the energy that they buy from residential solar is not particularly useful. In fact, most utilities buy solar from solar producers because the government forces them to credit users. In 43 of the 50 states utilities are required by law to pay net metering rates for solar electricity. In the states without regulation, residential solar is rarely compensated for being sold to the grid. This is because solar power from residences will offload power to the grid whenever they are producing with substantially more power being offloaded during sunny periods than cloudy periods. However, due to the lack of storage facilities this power is almost solely dependent on weather and therefore cannot be counted on by the utility to serve at any given time. The utilities must, therefore, maintain the capacity to offload the same amount of energy to the grid, as they would with no solar panels. In order to do this, utilities often will reach out to individual power providers who can at any time ramp up or down their energy production. This is where virtual power plants come in.

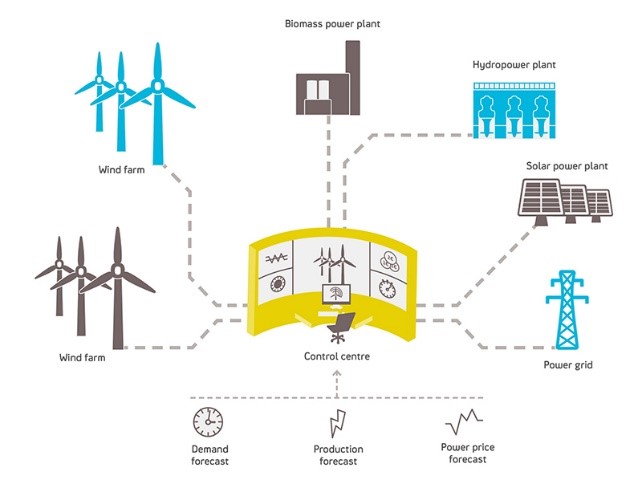

What is a VPP? A VPP is a conglomerate of hundreds or even thousands of medium to small energy producers. These producers are all coordinated using software that mimics the control room of a traditional power plant. The diagram below outlines the concept of a VPP.

In order for the VPP to work, these energy producers must either have large storage capacities or must be made up of a large variety of energy sources (i.e. wind and solar and thermal). Then, by the law of large numbers, these control rooms know that at any given time they can produce a certain amount of energy. If the requirement from the utility is less than their production capacity, they will switch many of their producers to store the excess energy, if the requirement is greater than their capacity to produce, the VPP will offload energy to the grid from their stored capacity. Each of the individual power producers would receive payment in accordance with how much energy was provided to the grid by their system. At current, most of these energy producers are medium scale producers: however, with the increase in prevalence of batteries, residential solar power could become a huge portion of these VPPs. Right now, the few VPPs that include residential solar credit their users rather than paying them directly for the energy. As residential power becomes more common, it is likely residential solar owners could choose to get paid money (not just credits) for the power they produce. In addition, this would allow utilities to count on and value residential solar rather than being grudging partners.

Conclusions on the future of the Solar Industry.

Many published articles and scientific papers forecast a booming solar industry. The industry has been growing incredibly rapidly, and it looks like that growth will continue. A factor that is rarely considered in these articles is the concurrent breakthroughs (and predicted breakthroughs) in the battery industry. However, batteries play a pivotal role in the future of the solar industry. In the commercial market, many solar farms already have and will add more energy storage. With reductions in price as well as increases in battery longevity and capacity, the savings incurred by using new batteries could be huge. In the residential market the arrival of inexpensive, effective batteries opens up market opportunities and will motivate consumers to go solar who otherwise may not have considered this option. Consumers who want better return on their solar investment, who want to have self-sustaining backup power or who want to be off the grid will all be much better equipped to meet their desires with solar and batteries. Finally, with the impending arrival of virtual power plants, residential solar producers could begin to see direct financial return on their investment. So, if as they say “the future of solar is bright”, the future of solar combined with batteries is super charged.

External Links

2. The Future of Solar is Bright

4. Solar Industry Growing At Record Pace

No responses yet